Employee payroll tax calculator 2023

All Services Backed by Tax Guarantee. This calculator is for 2022 Tax Returns due in 2023.

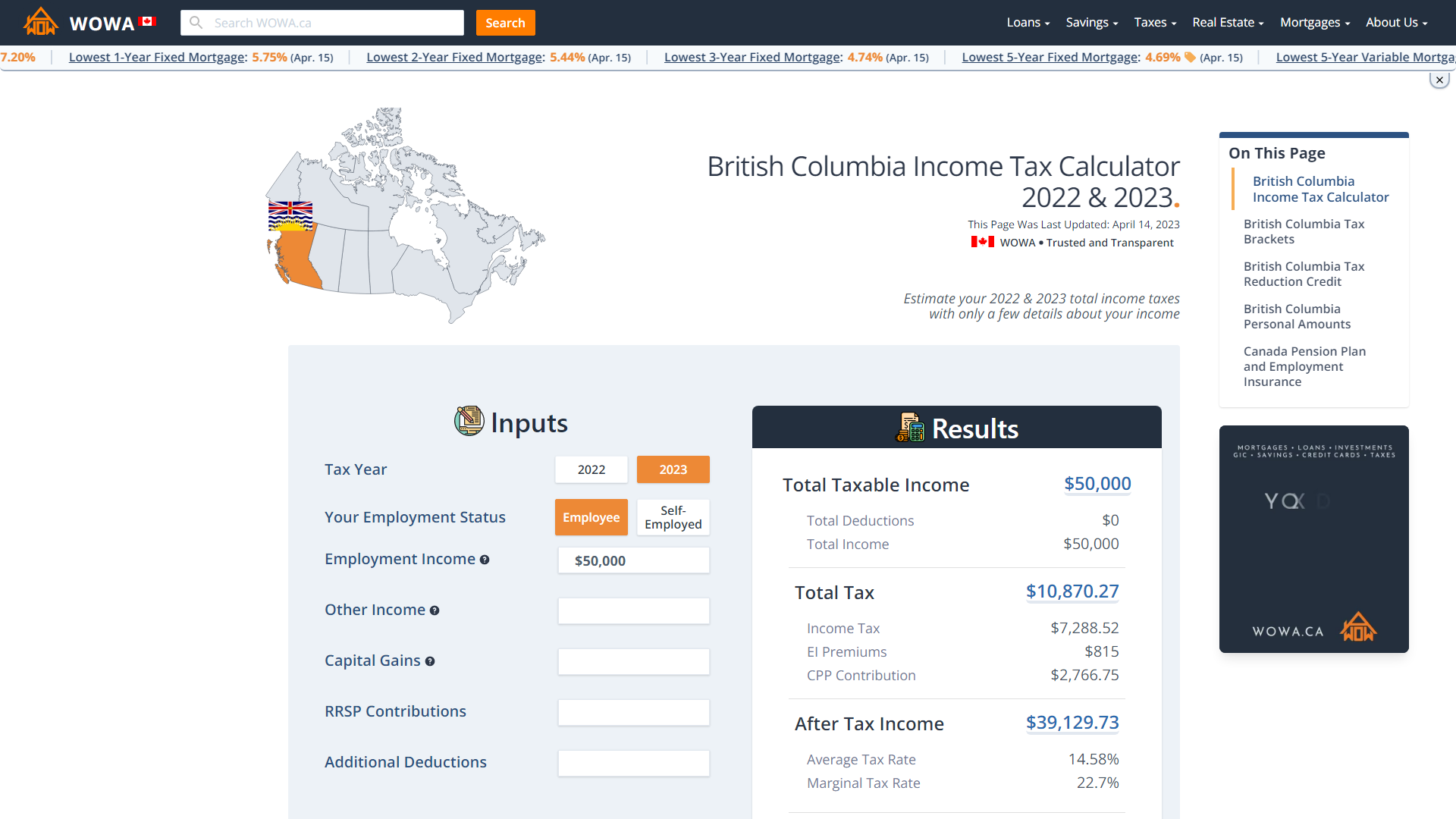

Bc Income Tax Calculator Wowa Ca

Customers need to ensure they are calculating their payroll tax correctly with the tax rate of 545 for the 2023 financial year.

. Ad Process Payroll Faster Easier With ADP Payroll. Unemployment insurance FUTA 6 of an. For example if an employee earns 1500.

Use SmartAssets paycheck calculator to calculate your take home pay per. Subtract 12900 for Married otherwise. 250 minus 200 50.

The payroll tax rate reverted to 545 on 1 July 2022. For example if an employee. SARS eFiling Tax Practitioner Auto-assessment New to tax SARS Income Tax Calculator.

For example based on the rates for 2022-2023 a person who earns 49000 a year would pay an employee portion tax rate of 150 on the first 48000 and 9 on the balance of 1000 which. Get Started With ADP Payroll. Prepare and e-File your.

Ad GetApp Has Helped More Than 18 Million Businesses Find The Perfect Software. Calculate your state local and federal taxes with our free payroll income tax calculator simply choose your state and you are all set. 2022 Federal income tax withholding calculation.

UK PAYE Tax Calculator 2022 2023. The Tax Calculator uses tax information from the tax year 2022 2023 to show you take-home pay. Ad Fast Easy Accurate Payroll Tax.

Free Unbiased Reviews Top Picks. Withhold 62 of each employees taxable wages until they earn gross pay of 147000 in a given calendar year. State Disability Insurance SDI Personal Income Tax PIT Note.

2022 Federal income tax withholding calculation. Increase the payroll tax rate to 161 up from the current 124 with no changes in the taxable income. SARS Income Tax Calculator for 2023.

Ad Compare This Years Top 5 Free Payroll Software. Get the Payroll Tools your competitors are already using - Start Now. Use our employees tax calculator to work out how much PAYE and UIF tax you will pay SARS this year along with your taxable income and tax rates.

There is also a special payroll tax rate for businesses in bushfire affected local government. The maximum an employee will pay in 2022 is 911400. Free Unbiased Reviews Top Picks.

The payroll tax rate reverted to 545 on 1 July 2022. The payroll tax rate reverted to 545 on 1 July 2022. Get Started With ADP Payroll.

The calculator is updated for the UK 2022 tax year which covers the 1 st April 2022 to the 31 st March 2023. Here are the provisions set to affect payroll taxes in 2023. 2022-2023 Online Payroll Tax Deduction Calculator.

Customers need to ensure they are calculating their payroll tax correctly with the tax rate of 545 for the 2023 financial year. Free Unbiased Reviews Top Picks. Then look at your last.

The effective date of change to the Withholding Tax tables is 112022 per Act 2022-292. Tax Deduction For Lifestyle up to RM 2500. Thats where our paycheck calculator comes in.

The standard FUTA tax rate is 6 so your max. Discover ADP Payroll Benefits Insurance Time Talent HR More. Ad Compare This Years Top 5 Free Payroll Software.

The tax is 10 of. Multiply taxable gross wages by the number of pay periods per year to compute your annual wage. Ad Process Payroll Faster Easier With ADP Payroll.

Employees pay into state payroll taxes with wage withholdings for. Ad Payroll So Easy You Can Set It Up Run It Yourself. Use our employees tax calculator to work out how much PAYE and UIF tax you will pay SARS this year along with your taxable income and tax rates.

Wages are generally subject to all four payroll taxes. That result is the tax withholding amount. Sage Income Tax Calculator.

This calculator allows employees to deduct 401 k or 403 b contributions for tax year 2022. Discover ADP Payroll Benefits Insurance Time Talent HR More.

What Is The Bonus Tax Rate For 2022 Hourly Inc

Simple Tax Calculator For 2022 Cloudtax

2022 Federal State Payroll Tax Rates For Employers

Supremecapitalgroup On Twitter Personal Financial Management Financial Institutions Financial Management

Understanding The Aca Affordability Safe Harbors Health Insurance Coverage Affordable Health Insurance Safe Harbor

Account Chart Bookkeeping Business Business Tax Deductions Accounting Education

![]()

Canada Income Tax Calculator Your After Tax Salary In 2022

2022 Federal Payroll Tax Rates Abacus Payroll

Simple Tax Calculator For 2022 Cloudtax

2022 Federal State Payroll Tax Rates For Employers

Selecting Stock Photos Royalty Free Images Vectors Video Diseno Curriculum Como Hacer Un Curriculum Curriculum

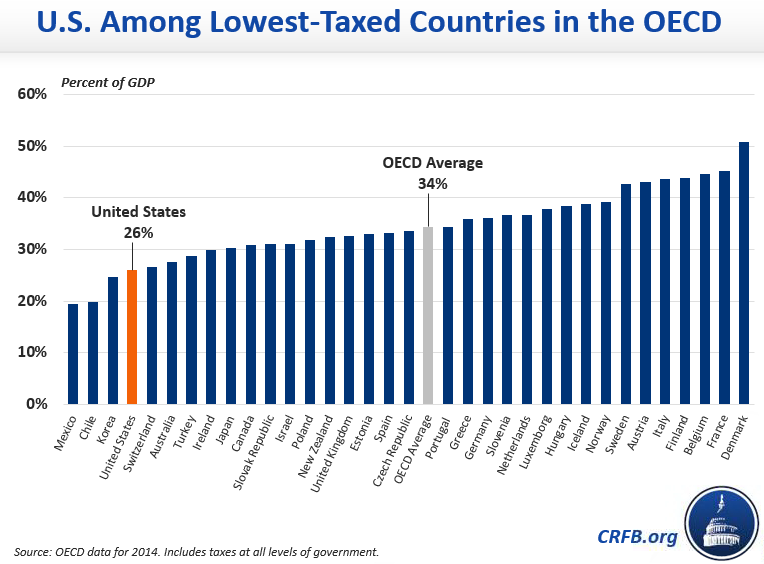

Is The U S The Highest Taxed Nation In The World Committee For A Responsible Federal Budget

2021 2022 Income Tax Calculator Canada Wowa Ca

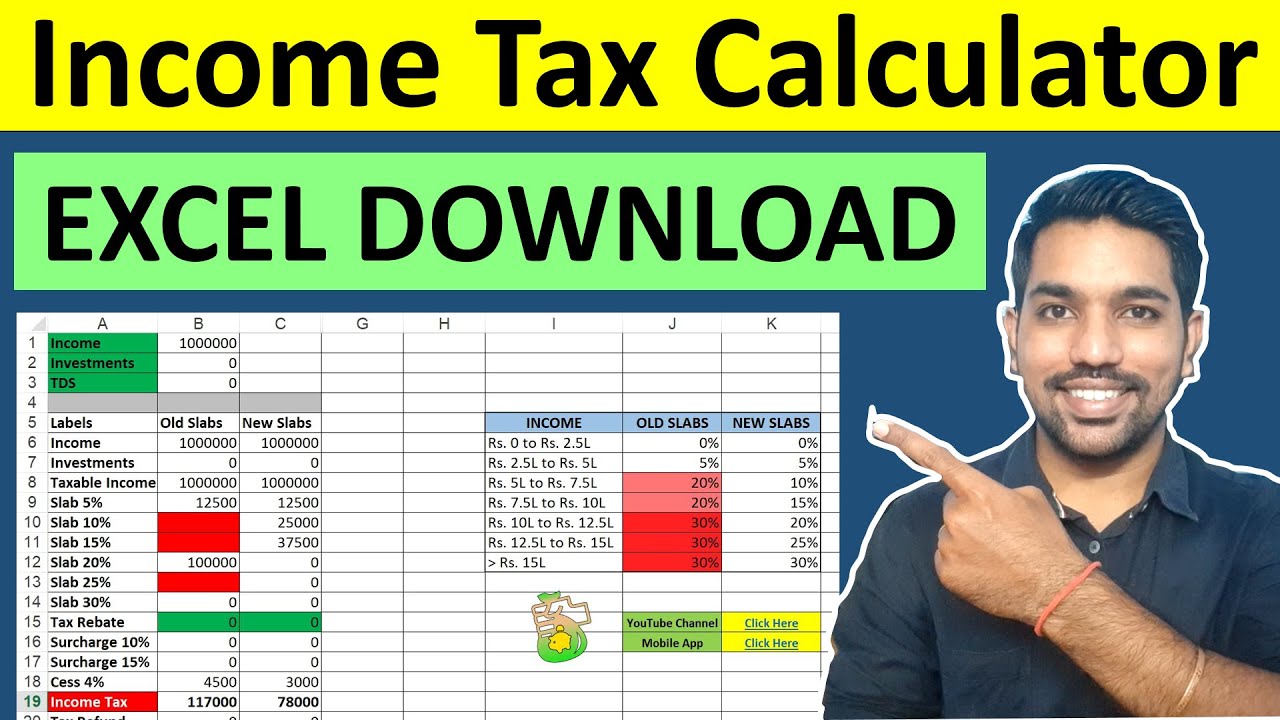

Income Tax Calculator Fy 2022 23 Excel Download Ay 2023 24 Youtube

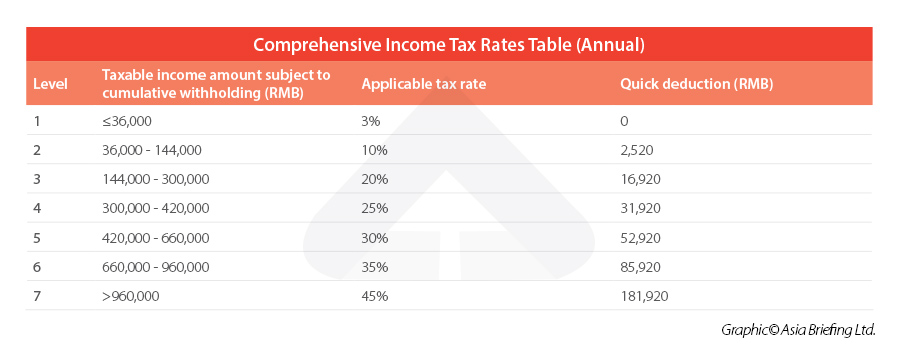

China Annual One Off Bonus What Is The Income Tax Policy Change

State Corporate Income Tax Rates And Brackets Tax Foundation

When Are Taxes Due In 2022 Forbes Advisor